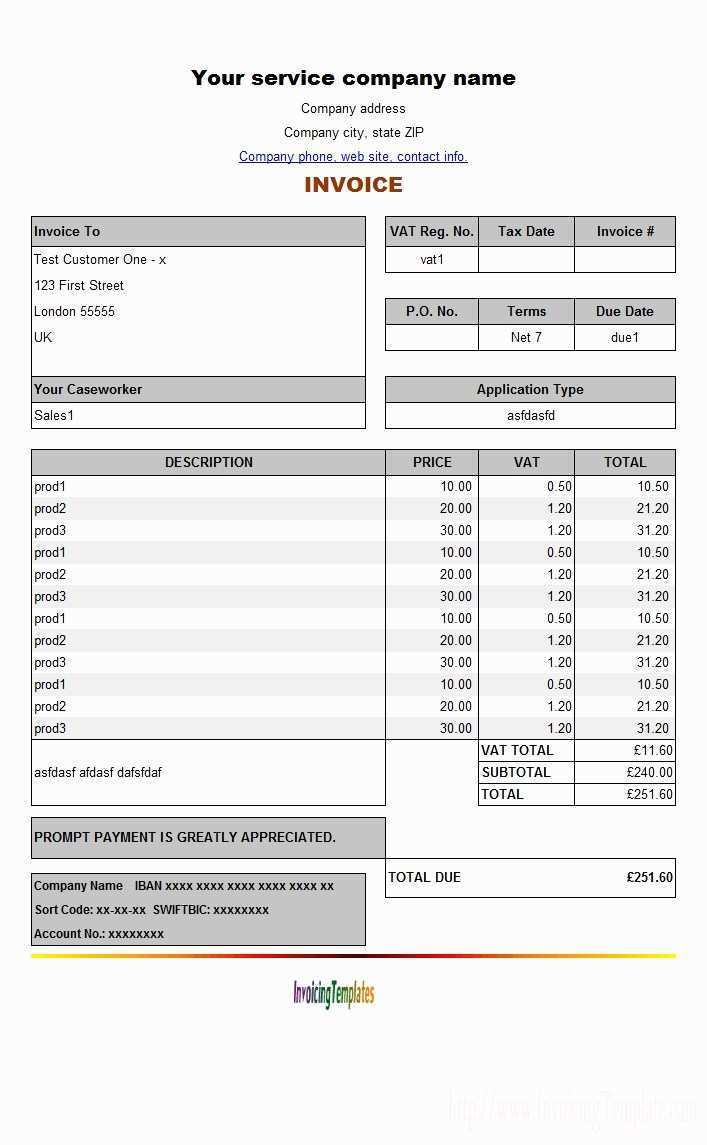

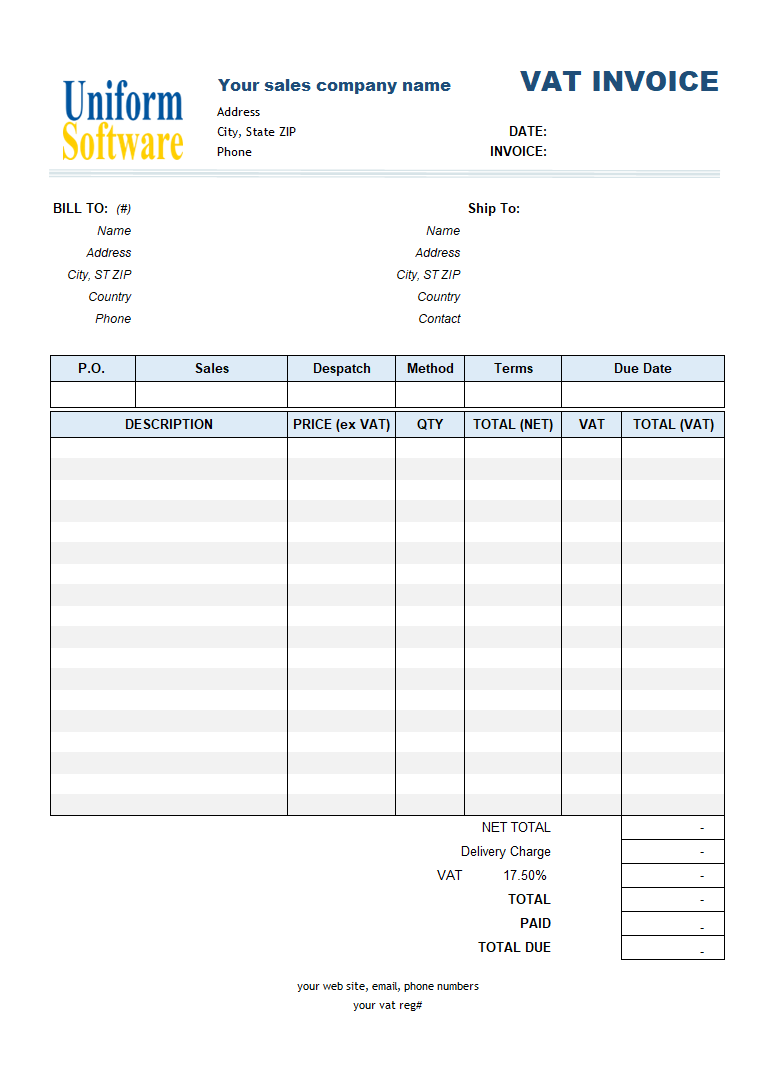

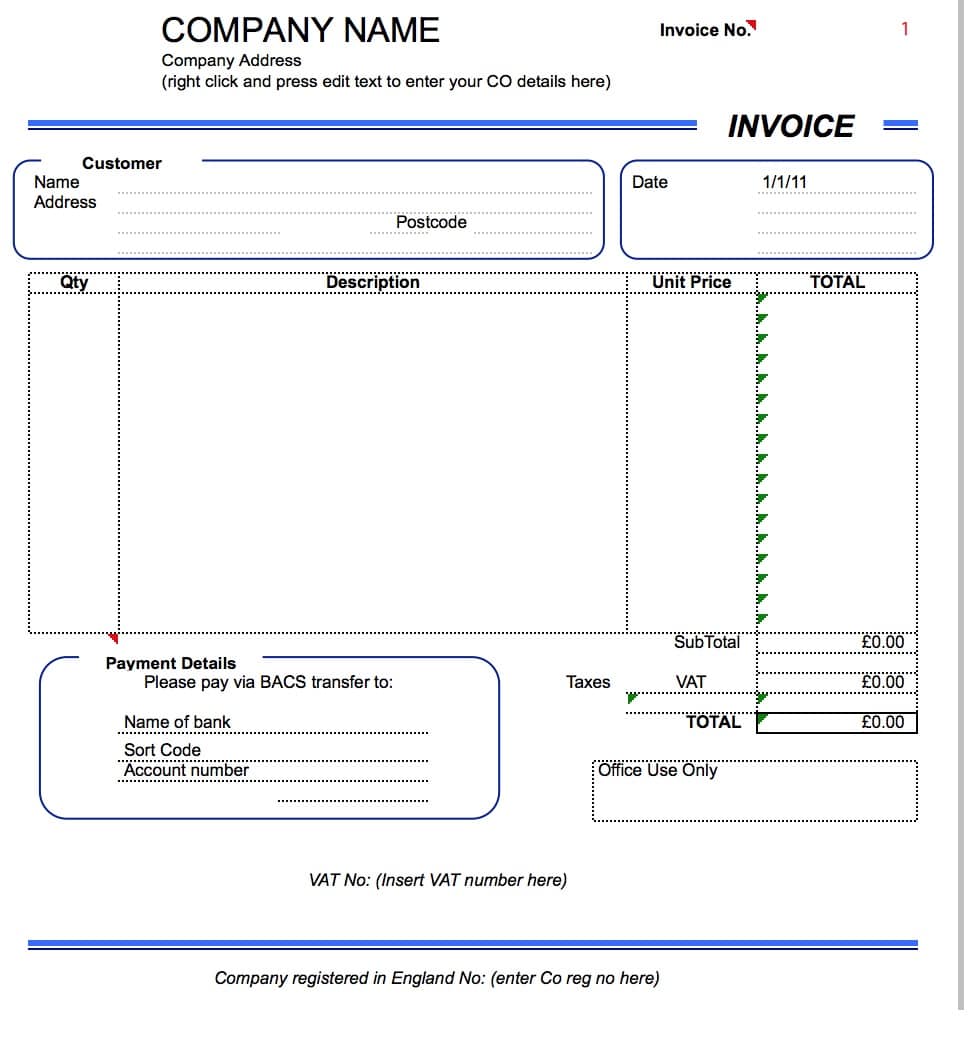

Yes, even if you don’t have a registered account, our invoice generator offers a customizable ready-made invoice template to create & instantly download the PDF copy of your Pakistan invoice or save the information to use later. How do I send a Pakistan VAT/No VAT invoice? Send the created PDF Pakistan invoice electronically or print it. In all kinds of jobs and businesses, there is a corresponding tax that must be paid that depends on the income and salary generated in a fiscal year; this liability often appears in the balance sheet or pay slip of a person to notify him or her that a tax must be paid to avoid further penalties, this can be created easily in Excel sheet using a General Invoice Template that can establish the. Download Word invoice template (non-VAT) Download Word invoice template (VAT) Excel invoice template. Using Excel to create invoice templates will help you quickly enter the details since you can use formulas to automatically update the prices. Below, you can download a free Excel invoice template and modify it for your business. Free invoice format download in xlt format for your business. It is free to download, edit, email, and print. This template can be used for most types of businesses and billing; it has place to add your logo and company address, data, invoice number, and a table for products or services.

Customers and vendors have a strong business relationship with each other. Customers would negotiate the best price for their deal. And negotiating a discount is the best part of any deal. The vendors would state the discounts available and the terms for the discounts on the invoice. The customers are very interested in avail of the discounts.

The discounts are a good way to keep the cash running a business. It has advantages for both the vendors and the customers. The discount invoice enables us to set any terms and conditions for availing the discounted prices. The customers can make an early payment to avail of the discounts. In this way, they can save up money by paying less on time and the vendor gets the advantage of secure payment.

Discount invoices are a good way to retain customers. Attracting customers by offering goods at discounted rates has been one of the most successful business strategies. And in return, getting the same product at cheaper rates is a benefit for the customer. Occasional discounts can help retain customer loyalty, as the customer will waste no more time in looking for cheaper vendors.

New customers can find it very attractive to get a discount just on the first purchase and making it sure to come back for future purchases as well. Discounts can be a good way to attract new customers as well as bringing back existing customers.

Regular purchases can help you get further reductions leading to great discounts.

Discounts can be simply understood as reductions to the original prices of goods or services. Making a discount on the selling items or services is a functional tactic of businesses that offer low prices to increase their sales, attract more customers, or clear their stock. Whatever be the reason a discounted transaction or sale requires a discount invoice.

When you use discount invoices you have to mention, the real amount that determines the size of the discount that is granted. Here you have to mention a service charge to invoices over a certain amount.

If you are generating an invoice for the discounts with sales, you must enter certain information in the invoice that exhibits which customers will be granted this type of discount and which discount percentages are suited to that particular customer. For each customer, you have to specify that the company will grant invoice discounts if the requirement is satisfied and for this, the terms and conditions for the availing discounts should be quite clear. The discounts are usually given in local currency for domestic customers and in foreign currency for foreign customers.

In discount invoices, discount percentages are also mentioned with the selling price and the discount price. This will inform the client how much percent off he is availing from the given discount. When all the items have been entered in the sales column, the invoice discount can be calculated for the entire sales document.

These calculations can be done manually, but with the recent advancements, online pre-formatted templates for discount invoices are available. These electric invoices have automated the calculating system, you just have to add a sale price and the digital invoice will calculate every discounted amount for you.

Preview

Discount Invoice Template

For: EXCEL(.xls) 2003 & later [Android+iOS] & iPad

DownloadFile Size: 38 kb

For: OpenOffice Calc [.ods]

Download File Size: 19 kb

[Personal Use Only]

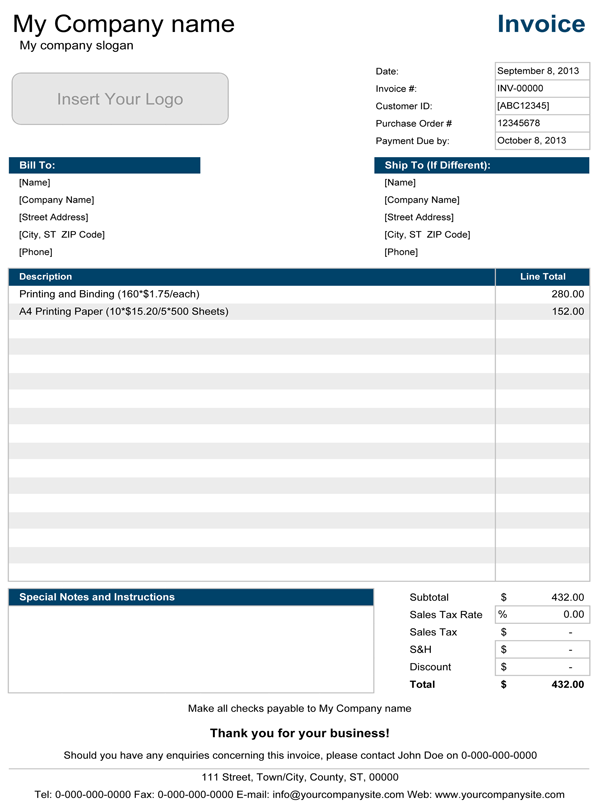

This new billing invoice template provides a very simple and professional way to bill your clients. We designed it specifically for freelancers, accountants, consultants, and other small businesses that are looking for something easy to use with a design that is easy to customize.

This template is the first in a line of new invoice and billing-related templates that will all use a similar style. This will allow you to create invoices, quotes, estimates, receipts, and account statements all with the same professional look.

Download

⤓ Excel (.xlsx)⤓ Google SheetsOther Versions

License: Private Use (not for distribution or resale)

'No installation, no macros - just a simple spreadsheet' - by Jon Wittwer

Description

This spreadsheet features a new clean and crisp design with the default color scheme set to grayscale for more ink-friendly printing. It's a piece of cake to change the color scheme, though. You can go to Page Layout > Themes > Colors, or edit the fonts and background colors to whatever you want.

The table includes a QTY (quantity) and a UNIT PRICE column so that you can enter labor charges as hours and rate and still list individual service charges. You can include a discount by entering a negative value in the UNIT PRICE column.

If you happen to live in a state that charges sales tax or gross receipts tax for services, you can use the second worksheet (the tab labeled InvoiceWithTax) that lets you include tax.

Download

⤓ Excel (.xlsx)

⤓ Excel (.xlsx)Description

This version of the billing invoice includes a section for defining different payment plan options. The customer can cut off this section and return it with their first payment.

License

Private Use (not for distribution or resale)

Download

Invoice Format In Word

⤓ Excel (.xlsx)Description

This version was customized specifically for legal professionals who charge based on an hourly rate. This template allows the descriptions to be fairly long. The descriptions wrap and the rows resize automatically.

License

Private Use (not for distribution or resale)

A Few Invoicing Tips

If this is your first invoice, start with an invoice number of 1042. You probably don't want your client to know that this is the first time you have ever billed anybody.

Mail it or send a PDF: When sending an invoice to a client, either print and mail a paper copy, or send a PDF. It is not as professional to send an invoice in an editable format like an Excel or Word document. It is extremely easy with Excel 2010 or later to create a PDF - Just go to File > Save As and choose PDF.

Terms vs. Date Due: Including the phrase 'Net 30 Days' in the TERMS field means that the invoice is due 30 days after the goods are received or the services have been performed. If you think your client may not understand that, you could change the label to DUE DATE and enter a date.

Oman Vat Invoice Format In Excel

Customer ID: If you are only billing a few clients, you may not need a Customer ID field. You could change the label to QUOTE # to refer to a previous quote, or you could just delete the label and leave the field blank.

Vat Invoice Template Excel

Creating a Receipt: If you need to give a client a receipt after they pay the invoice amount, you can just change the label at the top in cell H1 from 'INVOICE' to 'RECEIPT' and add a note below the Total saying something like 'Paid in full.'

We've automated this for you. In this template, all you need to do is select 'RECEIPT' from the drop down box in cell H1 and a note will appear below the total that says 'Paid in full. Thank you!'

See Also:

- Simple Invoicing - This article explains how you can organize your invoice files and store copies of the invoice for billing repeat customers.